Published Fri, 10:50 AM EDT Updated Fri, 11:29 AM EDT. You can learn more about Apple Card benefits here. The process takes just a few minutes, and if approved, your digital Apple Card will be ready for purchases immediately. What credit score you need to get an Apple Card and save 3 on the new iPhone 14. To apply for an Apple Card, simply open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. Goldman Sachs has since offered to reevaluate credit limits.

Last month, Apple CEO Tim Cook opined that the Apple Card has been the "most successful launch of a credit card in the United states ever," although that was before allegations surfaced of gender bias during the approval process. Apply without putting your credit score at risk. On purchases made outside of Apple or Apple Pay, the credit card offers a low 1 cash back rate. The current variable APR is 14.74 to 25.74 based on your creditworthiness, which. Length of Credit > 40 years Total Credit Limits >800K.

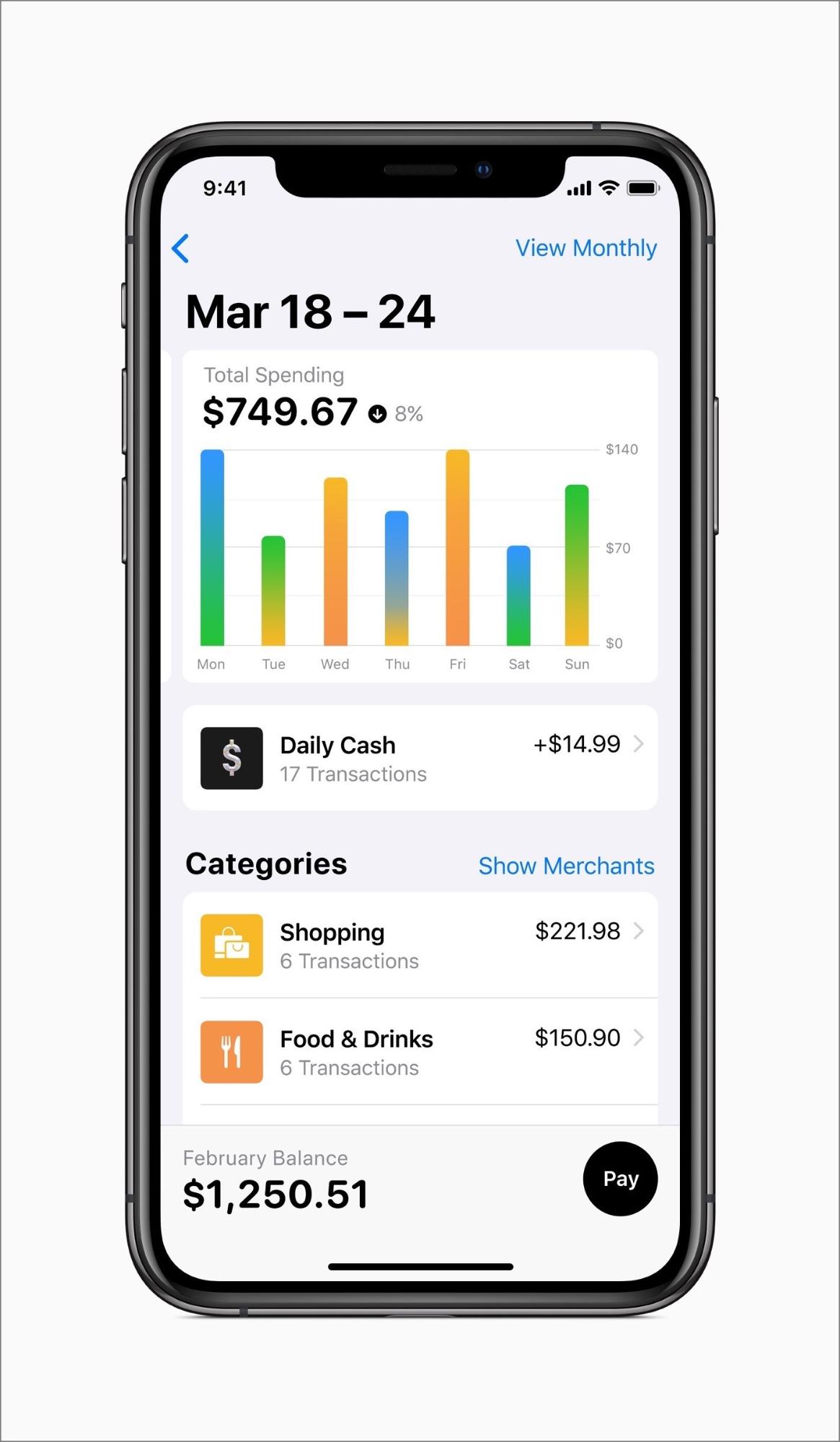

In other words, like any other credit card, the way you use your Apple Card can now have an impact on your credit score. Unlike other reward cards, the Apple card has a more sensible APR range. There are no annual fees, foreign transaction fees or late payment fees. I wish all cards operated this way My preapproval screen looked like this: Business Cards. This includes the date the Apple Card account is opened, credit balance, payment status, and more.

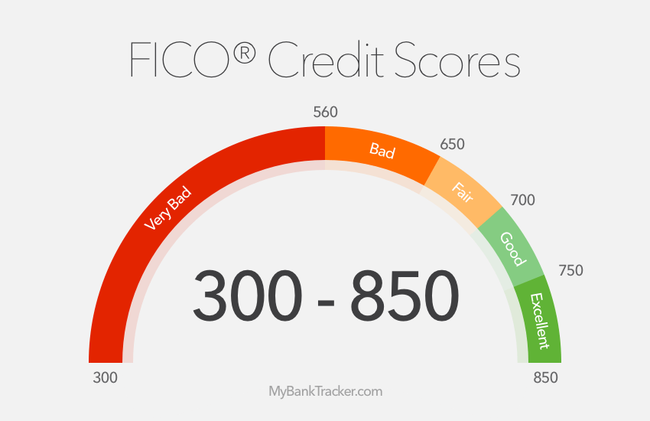

#Apple card credit score range full#

Goldman Sachs has confirmed that it is working with credit bureau TransUnion to begin reporting Apple Card information, informing cardholders that they will see full details on their credit report within the next five days. Nearly four months after rolling out in the United States, the Apple Card is now beginning to appear on credit reports.

0 kommentar(er)

0 kommentar(er)